- JP

- EN

MOL Establishes Sustainable Finance Framework; Using it for 5 Loan Deals

- Part of Ongoing Environmental Strategy Initiatives -

January 26, 2024

TOKYO-Mitsui O.S.K. Lines, Ltd. (MOL; President & CEO: Takeshi Hashimoto) today announced the establishment of a comprehensive Sustainable Finance Framework (Note 1) in line with its Key Principles (Note 2), including the "Climate Transition Finance Handbook 2023" of the International Capital Markets Association (ICMA). The company has also obtained a second-party opinion (Note 3) from DNV Business Assurance Japan K.K. (DNV), an international third-party certification organization, regarding its eligibility. The MOL can flexibly and continuously use this framework to raise funds through sustainable finance.

In addition, based on the Framework, the MOL Group has completed the signing of three Transition Loans (TL) and one Transition Linked Loan (TLL) financing agreement, as described below, and is scheduled to sign another TLL financing agreement as well. (Note 4)

Of the loans below, (1) and (2) have been selected by the Ministry of Economy, Trade and Industry (METI) as a 2023 Transition Finance Project (Note 5).

[Outline of Loans]

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Lender | Sumitomo Mitsui Banking Corporation | Sumitomo Mitsui Trust Bank, Limited | The Bank of Yokohama, Ltd. | The Bank of Yokohama, Ltd. | SBI Shinsei Bank, Ltd. |

| Contract Form | TL | TL | TL | TLL* | TLL* |

| Contract Signing Date |

December 20, 2023 | December 26, 2023 | December 26, 2023 | December 26, 2023 | Late January to February 2024 (scheduled to be concluded) |

| Use of Funds | Construction of two LNG dual-fueled ferries | Construction of bulk carrier equipped with Wind Challenger | Construction of LNG dual-fueled pure car and truck carrier (PCTC) | Construction of LNG dual-fueled very large crude carrier (VLCC) | Construction of LNG dual-fueled very large gas carrier (VLGC) |

* Transition-linked loans are a financing method that takes into account changes in loan characteristics (interest rates, etc.) based on the status of achievement of greenhouse gas (GHG) reduction targets that MOL has set (or will set) in advance.

The MOL Group has positioned environmental strategy as one of its major strategies and has set "marine and global environmental conservation" as one of sustainability issues (materiality) in the group management plan "BLUE ACTION 2035" formulated last year. We aim to achieve "Net zero GHG emissions by 2050" and will work collaboratively with our partners and stakeholders with creativity to resolve environmental issues. We will continue efforts toward sustainable finance by utilizing this framework in a funds procurement as well.

[Sustainability finance framework]

https://www.mol.co.jp/en/sustainability/management/finance/pdf/sustainable_finance_framework.pdf

[Second Party Opinion]

DNV Sustainable Finance Framework evaluation

(Note 1) This framework refers to the policy established by the procuring entity prior to the funding, and describes the use of procured funds, the process of project evaluation and selection, management of procured funds, reporting, and other key principles and other matters as defined in Note 2 below.

(Note 2) Applicable or referenced principles, etc.

| Principles and Guidelines | Issuer |

|---|---|

| Climate Transition Finance Handbook 2023 | International Capital Markets Association (ICMA) |

| Basic Guidelines on Climate Transition Finance, May 2021 Edition | Financial Services Agency, Ministry of Economy, Trade and Industry, Ministry of the Environment |

| Green Bond Principles 2021 | International Capital Markets Association (ICMA) |

| Green Loan Principles 2023 | Loan Market Association (LMA), etc. |

| Green Bond Guidelines 2022 | Ministry of the Environment |

| Green Loan Guidelines 2022 | Ministry of the Environment |

| Sustainability-Linked Bond Principles 2023 | International Capital Markets Association (ICMA) |

| Sustainability-Linked Loan Principles 2023 | Loan Market Association (LMA), etc. |

| Sustainability-Linked Bond Guidelines 2022 | Ministry of the Environment |

| Sustainability-Linked Loan Guidelines 2022 | Ministry of the Environment |

(Note 3) MOL has already obtained a second-party opinion from DNV dated December 22, 2023, to the effect that the framework's eligibility complies with the above principles and others, intending to ensure the eligibility and transparency of the framework and to improve its appeal to investors.

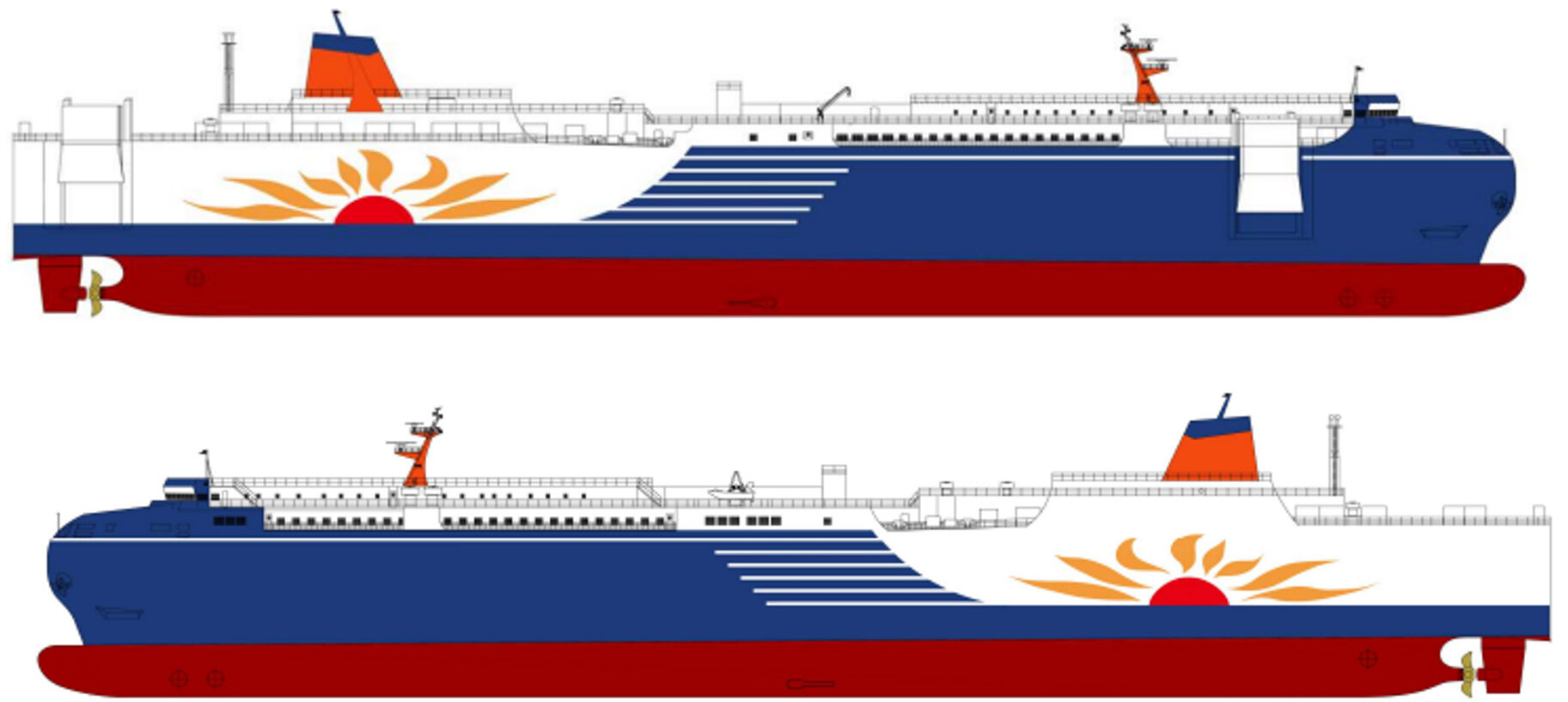

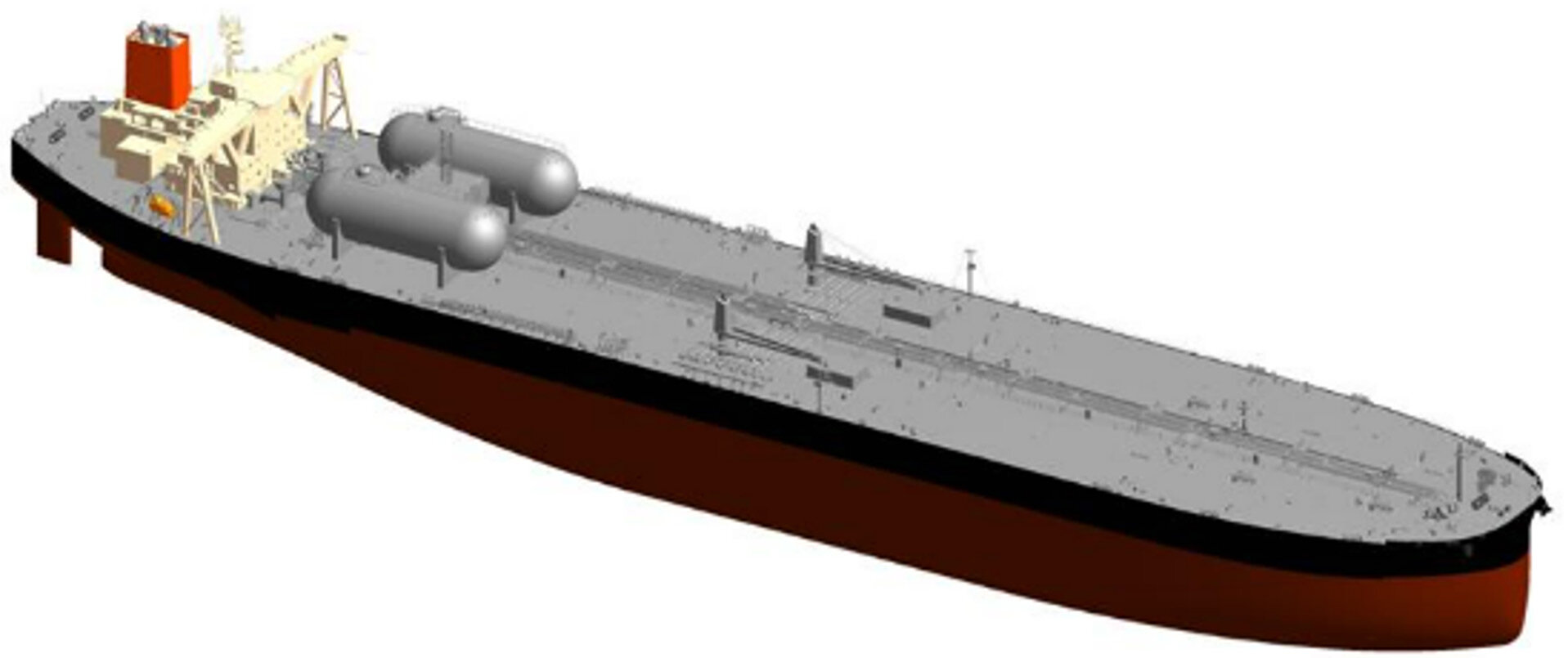

(Note 4) Use of Funds for Each Loan (CG rendering of vessels)

(1) LNG dual-fueled ferry

(2) Bulk carrier equipped with Wind Challenger

(3) LNG dual-fueled pure car and truck carrier (PCTC)

(4)LNG dual-fueled VLCC

(Note 5) Please see below for details on the Ministry of Economy, Trade and Industry's "Transition Finance Model Project."

https://www.meti.go.jp/english/policy/energy_environment/transition_finance/index.html

MOL Group 5 Sustainability Issues

MOL Group identifies "Sustainability Issues" (Materiality) as our key issues for sustainable growth with society through realization of the Group Vision.

We anticipate this initiative to contribute especially to the realization of "Environment -Conservation for Marine and global environment-."