- JP

- EN

Remuneration

Directors' Remuneration Policy/System

Policy for determining directors' remuneration

Remuneration Advisory Committee

MOL follows objective, transparent procedures to determine the individual remuneration of directors, according to resolutions by the Board of Directors based on deliberation/report of the Remuneration Advisory Committee chaired by an outside director. In addition, the committee reviews the directors' and executive officers' remuneration system appropriately to examine the ideal form for directors' remuneration, including incentives for long-term enhancement of corporate value, from an objective standpoint focusing on "stakeholders' viewpoint."

- Overview of the Remuneration Advisory Committee (Fiscal 2024)

-

- Percentage of outside directors: 66%

- Review frequency: 5 times/year

- Chairman: Outside Director Etsuko Katsu

- Members: Chairman Junichiro Ikeda

President & CEO Takeshi Hashimoto

Outside Director Masaru Onishi

Outside Director Atsushi Toyonaga

Outside Director Yumi Yamaguchi

- Main Agenda Items in Fiscal 2024

-

- Revision of the executive remuneration system (increase of remuneration levels and stock based compensation ratio, and strengthening of governance in the remuneration system);

- Single fiscal year performance-based compensation and long-term target contribution-based compensation for directors (evaluation of past fiscal year performance);

- Peer group review to ensure the appropriateness of remuneration levels; and other matters

Remuneration for executive directors

Overall structure

Based on the report of the Remuneration Advisory Committee, the Board of Directors meeting on March 28, 2025 approved to revise the remuneration plan for Directors and Executive Officers. Proposals concerning some of the revisions were approved at the FY2024 Annual General Meeting of Shareholders held in late June 2025. Application of the remuneration plan in accordance with the revisions shall start from remuneration for FY2025.

- Increase in levels of remuneration (For the CEO, the total annual remuneration is designed to exceed 200 million yen when the company's consolidated profit before tax reaches 200 billion.)

- Expansion of ratio of stock remuneration

- Introduction of clawback provisions

The revisions are being made for the purpose of changing the method of evaluation so that the level of remuneration is commensurate with results achieved in light of the management plan "BLUE ACTION 2035" and expanding the ratio of stock remuneration. Through these revisions, the Company intends to achieve a remuneration level that will also motivate employees to seek executive positions and to further encourage its officers to demonstrate a healthy entrepreneurial spirit, further share value with shareholders, and execute their duties in keeping with the Group's values and code of conduct "MOL CHARTS."

MOL also intends to further optimize corporate governance through officers' remuneration by adopting clawback provisions. MOL believes that achieving a globally competitive remuneration level and strengthening governance within the remuneration plan will contribute to the further enhancement of our company's long-term corporate value.

After the revisions, the ratio of fixed remuneration to variable remuneration will change from 60:40 to 44:56, and the ratio of cash remuneration to stock remuneration will change from 80:20 to 65:35. Furthermore, in addition to existing indicators for single fiscal year performance-based remuneration, MOL will adjust the remuneration based on the achievement level of the dividend payout ratio against the announced level in the management plan.

For Non-Executive Directors, in the same manner as Executive Officers, MOL shall increase the levels of remuneration for monthly remuneration and stock remuneration not linked to performance.

- (Note 1) On the premise of achievement of ¥100.0 billion in consolidated ordinary profit, which is the premise at the time of design of Company's executive remuneration system.

- (Note 2) On the premise of achievement of ¥200.0 billion in consolidated profit before tax.

- (Note 3) The above ratios and figures are calculated based on tentative business results and unit price for the Company's shares, and are for illustrative purposes only. The above ratios will vary according to factors such as changes in actual business results and the stock price of our shares.

| Remuneration classification | Weight | Period | Time of payment | Outline/Calculation method | |

|---|---|---|---|---|---|

| Fixed remuneration |

Monthly Remuneration (Cash) | 37% | 1 month | Next month | Monthly remuneration is paid as fixed remuneration based on responsibilities to encourage robust business execution. |

| Position-based stock (Stock) | 7% | 1 year | At the time of retirement |

Position-based stock is paid for providing an incentive to seek sustainable improvement in MOL's corporate value and further promoting the sharing of value with shareholders. | |

| Variable remuneration |

Single Fiscal Year Performance-Linked Remuneration (Cash/Stock) | 28% | 1 year | June of next year |

Single fiscal year performance-based remuneration (cash) is paid as variable remuneration reflecting short-term performance.

MOL will also introduce a mechanism for increasing the rate of payment associated with single fiscal year performance-based remuneration for the CEO when certain performance conditions set based on “BLUE ACTION 2035” are met, to increase the incentive to achieve management plan commitments in single-year financial results. *4 *4 refer to the "Schematic of single fiscal year performance-based remuneration(CEO)" shown in the margin. When the amount of remuneration calculated as single fiscal year performance-based remuneration exceeds a certain threshold specified by MOL's Board of Directors, MOL shall grant this portion in stock instead of cash. (Single Fiscal Year Performance-based Remuneration Stock-granting Plan) |

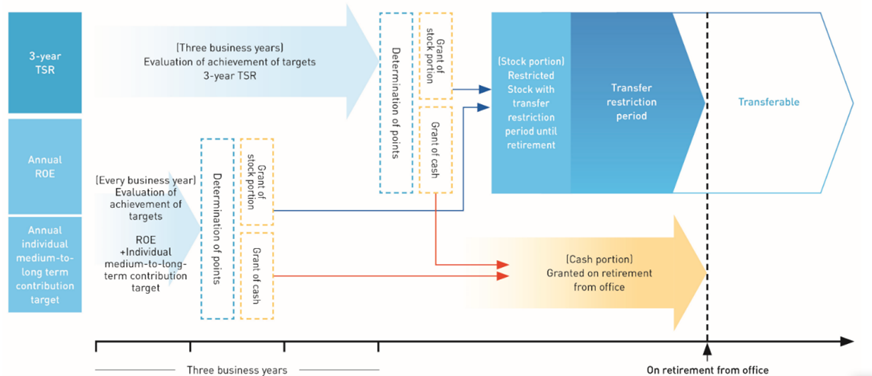

| Long-Term Target Contribution-Based Remuneration (Stock) | 28% | As shown in the chart below | As shown in the chart below | Performance-based remuneration (stock) system is adopted with the objectives of linking mid-to-long-term stock prices and business performance, and further share value with shareholders through increased shares held by directors (excl. outside directors) and executive officers. In this system, the remuneration is paid by share according to achievement level of a predetermined stock price index and performance index/target in a certain evaluation period of time. In addition, part of the remuneration is paid in cash with the objective of providing funds needed to pay taxes. |

|

Evaluation Indicators for Long-term Target Contribution-based Remuneration

| Indicators | Weight | Period | Payment time | Reason for choosing this indicator and details of evaluation |

|---|---|---|---|---|

| (a) Comparison of the Company's Total Shareholder Return (TSR) and growth rate of Tokyo Stock Price Index (b) Comparison of the Company's TSR growth rate to competitors' TSR growth rates |

30% | 3 years | At the time of retirement | Incentive to increase share price |

| ROE | 40% | 1 year | At the time of retirement | Incentive to improve profit attributable to owners of parent and increase efficiency of shareholders' equity |

| Individual medium- to long-term contribution targets | 30% | 1 year | At the time of retirement |

|

Remuneration for non-executive directors

Remuneration for non-executive directors, including outside directors, consists of basic compensation (monetary compensation) and stock compensation (restricted stock) not linked to performance (both fixed compensation), in order to implement shared shareholder value in addition to supervising business execution.

This remuneration system was newly introduced from fiscal year 2022, with a change to a structure in which 10% of the existing fixed monetary compensation amount of 100% is replaced by restricted stock (approximate).

(*) The above chart is a guide to the compensation ratio based on the assumption of a certain unit price of the company's shares.

Remuneration for Audit & Supervisory Board Members

Remuneration for Audit & Supervisory Board members is determined based on discussions between the members within the limits approved at the General Meeting of Shareholders, with consideration given to whether or not an Audit & Supervisory Board member serves in a full-time capacity, the amount of auditing work assigned, and the levels of director remuneration. Bonuses and stock options are not provided to Audit & Supervisory Board members.

Remuneration Performance

For details of executive remuneration, please refer to "Sustainability Data".

- Sustainability TOP

- Message from the Chief Sustainability Officer

- Sustainability

Management - Value Creation

Stories - Safety & Value

- Environment

- Human & Community

- Innovation

- Governance

- Stakeholder

Engagement - Sustainable Finance

- Sustainability Data

- ESG Disclosure

Guideline Indexes - External Recognition

- Library