- JP

- EN

Climate Change Countermeasures / Task Force on Climate-related Financial Disclosures (TCFD)

Recognizing climate change measure as one of its highest priority management issues, Mitsui O.S.K. Lines, Ltd. (MOL) has agreed with the Task Force on Climate-related Financial Disclosures (TCFD)* recommendations and moved ahead with initiatives required by TCFD.

* TCFD: The Task Force on Climate-related Financial Disclosures (TCFD) was established by the Financial Stability Board (FSB) at the request of G20 and issued recommendations on voluntary climate-related financial disclosures in June 2017 for the purpose of understanding and disclosing the potential financial impacts of climate-related risks and opportunities.

Contents

- 0. Overview

- 1. Governance

- 2. Strategy

- (1) Overall picture of climate change risks and opportunities

- (2) Overview of Scenario Analysis

①Scenario Assumptions

②Business environment assumed in each scenario - (3) Financial impact

①Specific examples of risks and opportunities

②Quantitative assessment of financial impact

③Prerequisites for each scenario

④New business opportunities related to climate change

⑤Transportation Demand Outlook for Existing Businesses

⑥Analysis of the risk of stranded assets - (4) Detailed analysis of physical risks

①Basic approach to physical risk

②Indirect risks that vary depending on the cargo

③Effect of indirect risk

④Indirect Risk Case Study - (5) Examples of how to respond to risks and opportunities

①Examples of Measures to Address Migration Risks

②Examples of Measures to Respond to Physical Risks - (6) Migration plan

①MOL Group Environmental Vision 2.2

②Five specific actions

- 3. Risk Management

- 4. Indicators and Targets

0. Overview

| Outline of Initiatives | Status of recent initiatives | |

|---|---|---|

| 1. Governance |

|

|

| 2. Strategy |

|

|

| 3. Risk Management |

|

|

| 4. Indicators and Targets |

|

|

1. Governance

(1) Governance status in relation to climate change

The Group considers environmental issues such as climate change, marine environment, biodiversity, and air pollution prevention, as well as issues related to sustainability in general, to be important management issues and has established a management structure with the CEO as the decision maker. The Chief Sustainability Officer (CSuO) oversees environmental initiatives, including climate change measures, and the Sustainability Committee (formerly the Environment and Sustainability Committee, renamed from FY2024), which is subordinate to the Executive Committee, is the main deliberation body. The Committee is chaired by the Chief Strategy Officer (CSO) and vice-chaired by the Chief Sustainability Officer (CSuO). Matters discussed by the Committee are reported to the Executive Committee and the Board of Directors as appropriate, and matters of particular importance are discussed and approved by the Executive Committee and the Board of Directors prior to implementation.

The Environment and Sustainability Committee convened a total of esix times in FY2023 and ten times in FY2024 to discuss key sustainability matters, with a particular focus on climate change. Of these, the Committee discussed in particular the enactment of the MOL Group Environmental Vision 2.2, which was followed by reports and resolutions at Board of Directors meetings and management meetings. At these meetings, the management team, led by the Representative Director, makes decisions.

With effect from FY2024, the Environment and Sustainability Committee was renamed the Sustainability Committee. The committee adopted a more flexible approach to deliberations, with more frequent meetings to discuss a wider range of topics. To enhance the Board of Directors' engagement in the review of sustainability management policies and strategies, a new 'Sustainability Discussion' was established as a standalone agenda item at Board meetings.

The Environmental & Sustainability Strategy Division was established in FY2021 to oversee the integration of the Group's sustainability efforts, the incorporation of sustainability initiatives into the BLUE ACTION 2035 management plan and the integration of climate change measures into business strategies. Concurrently, the MOL Group Environmental Vision was devised as a means of addressing climate change-related risks and opportunities, and comprehensive approaches to environmental issuesare being promoted. The Sustainability Committee is responsible for monitoring the status of the Vision on a regular basis. Furthermore, we will ensure that each initiative is aligned with our financial plan through internal linkages.

(2) Role of each conference organization

| Conference organization | Roles | Members | Achievements |

|---|---|---|---|

| Board of directors |

|

|

|

| Executive Committee |

|

|

|

| Sustainability Committee (formerly Environment and Sustainability Committee) |

|

|

|

- * Please refer to the "Corporate Governance Organizational Structure" page for details, including those not related to climate change.

- * Corporate auditors and executive officers who participate in the Board of Directors and Management Committee are appointed with the experience, insight, and expertise necessary for the Group's decision-making. Please refer to the "Governance Data" page for the skill map of the management team.

(3) Executive compensation linked to climate change

As part of its governance initiatives, the Company has implemented a system in which executive remuneration is linked to climate change-related results. The evaluation of the President and CEO and other executive directors is based on the progress of climate change measures and other ESG-related initiatives.

(Model remuneration for achievement of performance targets)

* Please refer to the "Remuneration" page for details.

2. Strategy

In response to the conclusion of the Paris Agreement in 2015, the IPCC Special Report on Global Warming of 1.5°C in 2018, and the results of scenario analysis conducted internally, MOL Group formulated an environmental vision as a long-term strategy and used this as the basis for its management strategies.

In terms of climate change mitigation measures, we will address transition risk by setting out in our environmental vision "Five Actions," hinging on the active adoption of clean alternative fuels, to achieve our medium-to-long term targets, including achieving "net zero GHG emissions throughout the entire value chain by 2050." As for adaptation measures, we will mitigate physical risks by ensuring multifaced actions both in terms of tangible and intangible factors, based on the organizational response of the Safety Operation Supporting Center providing support from the ground 24 hours a day, 365 days a year.

(1) Overall picture of climate change risks and opportunities

MOL strives to grasp various risks and opportunities expected to result from climate change, and monitors the status at the Sustainability Committee to identify the impact on our businesses from a long-term viewpoint.

Scope of verification:

- Demand for the transportation of commodities (energy, automobiles, grain, etc.) related to the global shipping business

- Business environment throughout the entire supply chain (including upstream and downstream) of the above commodities

- Business environment of shipbuilding sector as supply chain of ocean transport business

Expected Timing of Materialization:

short-to-medium term: 2025 - 2028, long-term: 2028 - 2050

| Main assumed risks and opportunities | Category | Events | Specific examples of risks and opportunities | Materialization timing |

|---|---|---|---|---|

| Transition risks | Policy and legal risks | Reinforcement of EEDI/EEXI* regulations | Increase in capital investment | Short and medium term |

| Carbon taxes and emissions trading | Increase in cost resulting from introduction of carbon taxes and emissions trading (EU-ETS, etc.) | Short and medium term | ||

| Technology | Spread of new marine fuel engines | Obsolescence of fossil fuel-powered vessels | Long term | |

| Markets | Change in energy mix | Decrease in fossil fuel transport volume and increase in business risks associated with this | Short and medium term | |

| Increased electrification | Decrease in crude oil transport volume associated with decline in demand for gasoline | Long term | ||

| Increase in newbuild vessel prices | Pressure on shipyard operations from growing demand for alternative fuel-powered vessels accompanied by increase in newbuild vessel prices | Long term | ||

| Physical risks | Acute risks | Flood/typhoon |

|

Short and medium term |

| Chronic risks | Drought | Changes in transport routes associated with changes in grain production areas | Short and medium term | |

| Opportunities | Products/ Services Markets |

Introduction of alternative fuel-powered vessels | Increased demand from shippers seeking lower-carbon supply chains | Short and medium term |

| Efficient operations and energy-saving facilities | Spread of efficient operation technology and energy-saving facilities (wind propulsion devices, etc.) | Short and medium term | ||

| Markets | Increase of ocean transport demand | Increase in transport volume of decarbonization-related cargos such as ammonia and hydrogen | Long term | |

| Increased electrification | Increase in transport volume of raw materials used in EVs and their components such as lithium and copper | Long term | ||

| Spread of clean energy | Building supply chains for offshore wind power generation, ammonia, and hydrogen | Short and medium term |

* EEDI and EEXI: fuel efficiency regulation for new and existing vessels introduced by the International Maritime Organization (IMO)

(2) Overview of Scenario Analysis

①Scenario Assumptions

MOL specifically examine in detail the impacts of climate change risks and, especially with respect to changes in cargo movements, each sales division, under the initiative of the Corporate Planning Division has prepared long-term forecasts that take the impacts of climate change into consideration. More specifically, we assumed three scenarios targeting FY2050: "2.6°C scenario," "well-below 2°C scenario" and "1.5°C scenario."

In addition to the above, we use the scenarios with higher temperature rise assumptions (Assuming an increase of 3.0 °C or more, equivalent to RCP7.0) in the verification of physical risks, and conduct risk analysis under severe conditions.

- 2.6°C scenario: governments materialize the environmental policies which have already been published; consistent with Stated Policies Scenario (STEPS) in IEA's World Energy Outlook 2023 (WEO2023).

- Well-below 2°C scenario: assumes that nations cooperate to achieve the SDGs, resulting in good progress on climate change mitigation; consistent with IEA's Announced Pledges Scenario (APS).

- 1.5°C scenario: assumes that the net zero emissions are achieved globally by 2050; consistent with IEA's Net Zero Emission by 2050 Scenario (NZE).

- In addition to the above, please refer to RCP7.0 for physical risk verification.

②Business environment assumed in each scenario

| Scenario | 2°C/1.5°C scenario | 2.6°C scenario | |

|---|---|---|---|

| Assumed business environment |

Risks | Materialization of transition risks predominantly

|

Materialization of physical risks predominantly

|

| Opportunities |

|

|

|

| Reference scenarios | IEA: WEO2021 SDS and NZE (Partially WEO 2023 APS and NZE) |

IEA: WEO2021 STEPS (Partially WEO 2023 STEPS) |

|

(3) Financial impact

MOL has identified the financial impacts of climate change-related risks and opportunities through scenario analysis as explained above. The results of scenario analysis suggest that increases in carbon tax and fuel cost would have a significant impact on the transportation business but we believe we can reduce this impact through the measures such as the introduction of alternative fuel-powered vessels, which is currently underway.

Please refer to the following section ("(4) Detailed analysis of physical risks") for the impact of physical risks such as floods, typhoons, and deforestation becoming more severe than they are today.

①Specific examples of risks and opportunities

Firstly, let us explain the impact of "rising carbon prices," which is a typical transition risk, by giving a concrete example.

In Europe, the European Emissions Trading Scheme (EU-ETS) has been extended to include international shipping from January 2024. We have estimated how much impact this will have on our vessels. Assuming that (1) the amount of emissions subject to the EU-ETS is calculated based on our actual operations in 2020, (2) the unit price of EU-ETS emission credits is US$100/t-CO2, and (3) 100% of the subject emissions are subject to the charge, the annual charge is estimated to be approximately 7 billion yen.

These charges form part of the financial impact of carbon tax in the scenario analysis mentioned below. We also plan to take action to address such carbon fees in the future including reducing our CO2 emissions by encouraging the introduction of alternative fuel-powered vessels and explaining the cost of carbon pricing to shippers.

②Quantitative assessment of financial impact

Furthermore, we have evaluated the quantitative impact of the realization of each scenario on MOL businesses. In our evaluation, we focused specifically on (i) changes in cargo movements, (ii) fuel cost, (iii) carbon tax, (iv) the introduction of alternative fuel-powered vessels and (v) new business opportunities.

The financial impact assessment by factor toward 2050 for each scenario is as follows (all figures are on a recurring income basis and represent amounts per single year, not cumulative).

Under the 1.5°C scenario, carbon tax will be a major factor in worsening profitability (negative impact of 270 billion yen). However, we expect to be able to achieve a sufficient level of profit by significantly reducing carbon taxation through the active introduction of next-generation fuel-powered vessels (positive impact of 240 billion yen) and by taking appropriate countermeasures such as expanding new business opportunities that tap into growing demand in the clean energy business domains including offshore windfarms and hydrogen and ammonia transportation (positive impact of 30 billion yen) and initiatives to broadly share the increased costs of carbon tax beyond the industries (positive impact of 110 billion yen), efficient operations and other new business.

-

Factors affecting profit/loss from now to 2050 (1.5°C scenario, unit: JPY 100 million, single-year basis)

Similarly, under the well-below 2°C scenario, carbon tax will squeeze profit due to the rising carbon tax rate (negative impact of 230 billion yen). However, we expect to be able to significantly reduce this cost increase through our own efforts to cut emissions via the introduction of next-generation fuel-powered vessels (positive impact of 190 billion yen). Additionally, higher fuel cost (a total negative impact of 90 billion yen attributable to the rising price of fossil fuels and the shift to alternative fuels) will be a factor worsening profit. However, as with carbon tax, we expect to be able to recoup most of this cost increase by recovering higher costs in our freight rates whilst still maintaining competitive terms (positive impact of 170 billion yen combined with carbon tax). In addition, we expect to ultimately succeed in generating a sufficient level of profit through the development of new business opportunities related to clean energy and efficient operations.

-

Factors affecting profit/loss from now to 2050 (well-below 2°C scenario, unit: JPY 100 million, single-year basis)

Under the 2.6°C scenario, higher fuel costs due to rising fossil fuel prices (negative impact of 140 billion yen) will be a major pressure on earnings. However, we expect to be able to recover higher costs in our freight rates based on the principle of competition in line with conventional business practices. Compared with the other two scenarios, the cost increase due to the introduction of carbon tax will be kept at a low level (negative impact of 120 billion yen), However, we will continue our efforts to ensure that the cost increase will be shared broadly beyond the industries, based on the principle that reduction of our direct emissions is directly linked to reduction of emissions in customer supply chains. Looking at other factors, in addition to growth in cargo movements in existing business divisions (positive impact of 30 billion yen), we expect to be able to achieve sufficient profit through initiatives such as mitigation of the impact of rising costs through the introduction of next-generation fuel-powered vessels and the promotion of efficient operations.

-

Factors affecting profit/loss from now to 2050 (2.6°C scenario, unit: JPY 100 million, single-year basis)

③Prerequisites for each scenario

IEA's "World Energy Outlook 2021." is referenced and various conditions are quoted. For carbon tax and fuel prices, which are cost items with a particularly significant impact, we used the following values.

-

Carbon tax

Present price

(2020)2050 price 2.6°C

scenarioWell-below

2°C scenario1.5°C

scenarioCarbon tax (U$/t-CO2)* 0 90 200 250 * Carbon prices in advanced economies indicated in the corresponding IEA scenario are adopted

-

Fossil fuel prices

Present price

(2020)2050 price 2.6°C

scenarioWell-below

2°C scenario1.5°C

scenarioCrude oil prices (U$/bbl) 42 88 50 24 LNG prices (U$/ton)* 495 738 439 352 * LNG equivalent of the average natural gas price in each region indicated in the corresponding IEA scenario

④New business opportunities related to climate change

Global expansion in demand for clean energy is generating a wide range of new business opportunities that have a high affinity with the expertise MOL has developed in its existing businesses. As one of the Five Actions in MOL Group Environmental Vision 2.2, MOL has adopted "Action 5 Expanding Decarbonization Projects through the collective efforts of the entire Group" and is working to develop new business domains with contributing to the reduction of society's GHG emissions.

As the world builds a new clean energy supply chain, MOL aims to increase value at each stage of the clean energy supply chain and contribute to the decarbonization of society via the social implementation of decarbonization projects.

Here we will highlight new business opportunities in the offshore wind power related business field and the ammonia and hydrogen transportation business field as typical examples.

-

Offshore wind power

Offshore wind power is a renewable energy market that is deemed certain to grow in the future. According to IEA, demand for massive new offshore wind farms is expected to continue increasing dramatically in the future under all scenarios, with total offshore wind capacity growing to slightly more than 500GW by 2040 under the well-below 2°C scenario and to just over 300GW under the 2.6°C scenario. Offshore wind is expected to become a major power source, accounting for just over 5% of the world's energy mix by 2040 under the well-below 2°C scenario and for just over 3% under the 2.6°C scenario.(Source: IEA "Offshore Wind Outlook 2019") Drawing on expertise in the development of marine infrastructure accumulated in its marine transportation business, MOL has already begun executing some projects, aiming to participate in projects at every stage of the offshore wind power value chain.

Please click here to view examples of specific initiatives.

We estimated based on the assumptions used in scenario analysis that by maintaining such comprehensive initiatives, the following profitopportunities can be expected in the offshore wind power-related business field as a whole (as of 2050).

(Billion yen) 2.6°C Well-below 2°C 1.5°C Offshore wind power-related business 9.0 17.0 24.0 -

Ammonia and hydrogen transportation business

Ammonia and hydrogen are expected to replace fossil fuels as a new mode of energy utilization. According to IEA, ammonia and hydrogen will account for 24.3 EJ of total final energy demand in 2050 (1.5°C scenario) and are expected to become major forms of energy consumption, accounting for around 7% of global final energy consumption.

MOL has already started executing some projects, aiming to participate in projects at every stage of the ammonia and hydrogen supply chain, including business opportunities from tapping into new demand for transporting ammonia and hydrogen as cargo in addition to their use as fuel to power MOL's vessels

Please click here to view examples of specific initiatives.

We estimated based on the assumptions used in scenario analysis that by maintaining such comprehensive initiatives, the following profit opportunities can be expected in the ammonia and hydrogen transportation business field as a whole (as of 2050).

(Billion yen) 2.6°C Well-below 2°C 1.5°C Ammonia and hydrogen transportation related business 1.0 6.0 11.0

⑤Transportation Demand Outlook for Existing Businesses

We have established a long-term outlook for cargo transport demand under each scenario as follows. Depending on the scenario, energy division (fossil fuel transport business) demand may decline significantly. However, if we also take growth of demand in other divisions such as the product transport into consideration, the fluctuation in cargo demand in existing businesses (in value terms) is expected to remain in the range of +17% to -5% between now and 2050 depending on the scenario and we expect that this fluctuation will not have a decisive financial impact.

- Under the 2.6°C scenario, although demand for certain cargoes such as coal will weaken slightly, demand will increase in most cargo segments and cargo movements will increased by 17% in total between now and 2050.

- Under the well-below 2°C scenario, demand for the transport of coal and oil cargoes will decrease significantly but, on the other hand, product transport and drybulk (grain, etc.) demand is expected to grow and cargo movements are expected to increase by 3% in total.

- Under the 1.5°C scenario, transport demand for all fossil fuels including LNG will fall sharply but this decline will be offset by growth in product transport demand, and cargo movements will only fall by 5% in total.

⑥Analysis of the risk of stranded assets

As the world transitions to a decarbonized society, the risk of a decline in the value of certain assets ("stranded asset risk") is becoming increasingly important. A typical example of stranded asset risk in the shipping industry is the risk that the value of vessels that transport fossil fuels will decline as the use of new energy sources increases and the demand for vessels that transport fossil fuels declines (e.g., a decline in demand for oil tankers due to lower demand for oil ⇒ a risk of tanker assets value to be impaired).

To address these risks, we have first developed a forecast of cargo movement growth rates for our main cargoes through to 2050 in relation to the long-term outlook for changes in transport demand under different scenarios depending on the degree of progress in climate change mitigation ("Megatrend Analysis" - see here for more details).

In addition, a very long-term fleet development plan consistent with the reduction targets set in "Environmental Vision 2.2" was developed ("GHG Reduction Roadmap", the fleet plan by ship segment until 2050). In the plan, we have introduced a process of checking the fleet plan from time to time to ensure that it is sufficiently resilient to changes in the external environment, while referring to the transportation demand forecasts for each segment in each scenario created by the megatrend analysis.

By monitoring transportation demand trends on a regular basis, we can identify potential issues and implement a business process for all shipping segments that allows us to swiftly adjust fleet plans in response to changes in demand. This ensures that we are adequately prepared for the risk of stranded assets.

(4) Detailed analysis of physical risks

①Basic approach to physical risk(Direct risk and indirect risk)

The physical risk assessment generally covers buildings, factories, and other real estate owned by companies. Since our main business is international maritime, the assessment covers vessels (movable property) that sail freely at sea. Movable goods such as ships are subject to two types of risks: direct risk, in which natural disasters such as floods and typhoons damage the ship itself, and indirect risk, in which disrupted supply chain of cargo for shipping would lead to reduced transportation demand.

Compared to land-based real estate, direct risk is inherently resistant due to its ability to navigate freely at sea. In addition to not being directly affected by acute risks on land such as floods, droughts, and wildfires, it is possible to avoid direct risks by avoiding severe weather even in the case of typhoons at sea. In addition, we can directly reduce risks by establishing a network that provides accurate forecasts of weather and sea conditions, instantly sharing the information with all operating vessels, and maintaining a business process to select the appropriate route. There is a possibility that this will be exposed in the form of an increase in marine insurance premiums over the long term, but the impact is currently considered to be limited.

On the other hand, indirect risk has the potential to manifest itself in various ways. In general shipping companies such as our company, the transported cargo spans a wide variety of industries, such as automobiles, steel raw materials, grains, and fossil fuels. The risk of supply chain fragmentation varies depending on the industry. Therefore, indirect risks are expected to have a wider range of risk events and require detailed consideration.

| Type pf risks | Overviews | Impacts on our business |

|---|---|---|

| Direct risks |

|

Unlike land-based real estate, it is possible to avoid and minimize damage by moving based on appropriate weather and sea forecasts. |

| Indirect risks | Risk of disrupting the supply chain of cargo for shipping, leading to reduced transport demand. | Impact analysis is important because the impact varies depending on the characteristics of the cargo and uncertainty is high. |

②Indirect risks that vary depending on the cargo

Since the impact of indirect risks on our business varies greatly depending on the cargo to be transported and the risks to be generated, we are conducting comprehensive analysis of major cargo and risk events.

We believe that the impact of indirect risks in each business can be determined by three characteristics: A. cargo, B. transport vessels, and C. transport contracts.

It can be considered that the following characteristics are likely to lead to supply chain disruption due to climate change: the production/demand base of the target cargo is biased (ubiquity), there is no alternative commercial material (lack of versatility), the vessels used can be applied only to specific cargo (rigidity), and the transportation contract is difficult to switch (rigidity).

| Overviews | Examples of high indirect risk |

Examples of low indirect risk |

|

|---|---|---|---|

| A. Cargo |

|

Automobile | Coal Grain |

| B. Transport vessels | [Rigidity of vessels] When the transportation demand of the target cargo decreases, such as for LNG carriers, it is difficult to load the substitute cargo and the operation rate of vessels may decrease. | LNG-fueled ocean-going vessel | Dry bulk vessel |

| C. Transport contracts | [Rigidity of contract] For LNG carriers and other vessels with long-term charter contracts, physical risk may reduce the utilization rate. | Long-term ship contract | Spot contract |

A. Type of cargo

The higher the fluidity of the commodity is, the more flexible it is to respond to supply chain disruptions in general. Even if one production site is damaged, the supply chain is maintained by transferring the site to another. Shifting production base will affect shipping companies, but it is unlikely to lead to a complete supply disruption, and cargo movement, which is a demand for shipping companies, will be maintained above a certain level.

For commodities such as oil, coal, and grain which international market transactions are generally conducted, even if physical risks occur in certain regions, the impact on cargo movement is likely to be relatively minor as other regions substitute functions, and even if there is a temporary decrease in demand, it is unlikely to lead to a situation in which the operation of the ship itself stops (Risk of inactivity).

On the other hand, in the case of finished automobiles where a specific model is produced at a limited production site for a specific demand location, the impact of supply chain disruption is likely to lead directly to supply disruption, and the risk of temporary ship outage is higher than in the case of general-purpose commodities.

B. Type of transport vessels

If the supply chain of the target cargo is disrupted and the demand for freight transportation fluctuates, a versatile ship type (e.g., a dry bulk ship) can load cargo categories other than the relevant cargo to avoid non-operation.

As an example, the main target cargo of a dry bulk ship includes coal, grain, and ore. However, even if the ship temporarily loses its cargo due to damage to the coal supply chain, the ship can still carry other cargo.

Fluctuations in demand for target cargo naturally affect the shipping business, but the impact is limited because the availability of ships is kept at a certain level due to the presence of substitution demand.

On the other hand, in the case of an exclusive ship type with low versatility (e.g., an LNG carrier), there is no option to load an alternative cargo when the supply of the cargo is interrupted because the target cargo is limited to LNG. This type of ship is prone to the risk of non-operation, and the impact is significant.

C. Transport contracts

In addition to the type of freight, the impact of indirect risk varies depending on the type of transportation contract.

A vessel of a spot contract can immediately switch to another cargo even if the supply chain of one target cargo is interrupted. However, a vessel engaged in a long-term exclusive contract cannot flexibly and quickly change cargo.

Compared to ship types for which ship market with high fluidity has been formed, ship types for which the ratio of long-term exclusive contracts is large and generalization has not progressed (Some LNG carriers, methanol carriers, etc.) have a relatively large risk of non-operation.

③Effect of indirect risk - Combined and Two-sided Impact -

When an event such as a supply chain disruption occurs, the event often has a multifaceted impact with mixed results in the shipping industry and does not necessarily have a negative impact on our business.

As an example, if the supply chain of an item is disrupted, as long as the demand side is not damaged, an alternative supply will be developed over time, thereby restoring load movement. If the replacement supply comes from further afield than before, the realignment of the supply chain could increase the tonnage demand, leading to a surge in market conditions. In addition, if demurrage occurs due to supply disruptions, there may be a shortage of vessels to be sent to other ship demand areas, resulting in an increase in the unit cost of transportation due to tight transportation demand. Therefore, the impact can be both positive and negative.

As such, the unique situation in the shipping industry of operating assets that inherently move across regions can have multiple and double-sided consequences for risk events.

④Indirect Risk Case Study

Physical risk exposure in the shipping industry is very broad, and its impact is two-sided. In our company, case studies are conducted with reference to past cases and the IPCC RCP7.0 scenarios to assess the impact of indirect risks on our company.

Since the impact of chronic risks such as sea level rise is small due to the fact that the sea can be freely navigated, this case study focuses on acute risks only.

- Risk Case (1) Major flooding in inland Thailand causes submergence of automobile production plants (acute risk)

-

Risk Case Summary

In July 2030, Thailand was hit by record torrential rains that caused massive flooding. Damage occurred in a wide area of Thailand, and 10 industrial parks in the surrounding area, especially in Bangkok, were submerged for 3 months over a wide area. In Thailand, flooding occurred frequently during the rainy season, and submergence happened by several centimeters which is equivalent to the height of a car. However, this time, many roads in Bangkok were interrupted, and railway operations starting from Bangkok were suspended, which had a significant impact on transportation and traffic in Thailand. The water completely receded around January of the following year, half a year after the disaster occurred.Impact of Risks on our Business

- Negative impact on our business: Reduction in transportation volume due to temporary production failure

Automobile and parts factories located in the flooded industrial park were severely damaged and operations were suspended. In addition to the finished automobile, the equipment of the assembly plant was damaged, and the restoration requires the same investment as a new plant. Even if the factory itself is not damaged, production activities will not be able to continue as usual due to difficulties in parts procurement and shipment.

In the short term, it will take about a year to restore the production base and resume production. During that period, finished automobiles will not be able to be shipped, resulting in a net reduction in sea transportation from Thailand. In addition, demand for the transportation of steel products to Thailand may be affected as well, and there are concerns that this will spread to related industries. - Positive Impact on our business: New Demand Due to Transport Route Changes

In the shipping business, we believe that the relocation of production bases due to the fragmentation of supply chains would not have only a negative impact. In FY2022, Thailand produced approximately 1.7 million automobiles, with 950,000 exported and 750,000 sold in Thailand. Even after the suspension of production in Thailand, demand in Australia and other export destinations has remained unchanged, resulting in new shipping demand from alternative shippers. In addition, due to the malfunction of the production base, it is necessary to meet the demand for 750,000 units/year of sales in Thailand by importing before production resumes, thereby creating new shipping demand to Thailand from other production sites.

In our company's finished automobile transportation business, it is expected that during the period of alternative shipments, the number of vehicles transported by alternative routes, such as those from the Far East to Australia, will increase. - Example of quantitative evaluation

In our finished automobile transportation business, while there is a net decrease in the transportation of finished vehicles from Thailand in the short term, we will incorporate new transportation demand from Japan, South Korea, and China to Australia as an alternative demand to prevent a major drop in the number of vehicles transported throughout our company. As an example, when we estimate the impact on services from Thailand to Australia, the impact on our company's ordinary income would be + 100 million yen if approximately 50,000 vehicles were switched from Thailand to the Far East, and if we were able to change the shipping route efficiently.

As such, due to the nature of the international maritime business, we believe that the impact of flooding on our business is not necessarily unidirectional, could be positive and negative, and we will continue to analyze the impact.

- Negative impact on our business: Reduction in transportation volume due to temporary production failure

- Risk Case (2) A large-scale typhoon in coastal China damages port infrastructure (acute risk)

-

Risk Case Summary

From August to September in 2040, one of the world's largest typhoons made landfall around Shanghai, maintaining its strength. More than 100,000 people were killed and major impacts occurred, including damage to port facilities necessary for shipping and major changes to navigation routes.

Shanghai Port, a major port in China, was badly damaged, and cargo handling facilities such as gantry cranes were damaged beyond repair, resulting in long-term effects that required one to two years to restore the port.Impact of Risks on our business

As the port of Shanghai is severely damaged, it will be difficult to unload various types of cargo, especially dry bulk transportation such as iron ore vessels. However, it is possible to cope with this by changing the transportation route which means unloading at ports where unloading is possible, such as the nearby Ningbo Port, and carrying out land transportation.

Thus, there is a potential risk of alternative transportation via land and air transportation routes for the failure of port functions. However, we believe that China already has sufficient resilience against the risk of port dysfunction because there are many ports and it is possible to establish a new supply chain in which raw materials are unloaded from other ports and shipped ashore. Although there may be some loss due to the onshore route, it will be relatively small compared to the overall transportation revenue and the impact on our business is expected to be very limited.

- Risk Case (3) Decreased water level in the Panama Canal reduces transit capacity (acute risk)

-

Risk Case Summary

In 2030, repeated droughts caused the water level of Lake Gatun, which provides water to the Panama Canal, to drop. In response, the Panama Canal was severely restricted, and its capacity was greatly reduced. This resulted in a significant drop in capacity of the Panama Canal. Vessels waiting for passage through the Canal were forced to stay at both ends of the Canal, and some of the vessels had to change their routes, resulting in a significant increase in the distance they had to travel.Impact of Risks on our business

Immediately following the event, shipping companies are expected to experience a negative impact on profits and losses due to temporary delays in the Panama Canal and increased operating costs resulting from changes in shipping routes. Conversely, if the situation persists and delays and route changes become a regular occurrence, freight and charter rates are expected to adjust upwards to reflect this. If the market does in fact experience a surge, it can be assumed that this will have a positive impact on the profit and loss of the shipping company. Consequently, the impact is two-sided and difficult to evaluate simply.

(5) Examples of how to respond to risks and opportunities

In order to demonstrate resilience in all scenarios, we will take the following various measures.

* Timelines for implementation of countermeasures: All measures are to be implemented in a short period of 5 years or less unless otherwise stated.

①Examples of Measures to Address Migration Risks

| Climate change risks and opportunities | Impact on MOL businesses | Countermeasures | |

|---|---|---|---|

| Products impacted | Overview | ||

| Change in energy mix | LNG | Under the 2.6°C scenario and well-below 2°C scenario, the level of demand will increase between now and 2050. Under the 1.5°C scenario, demand will trend down. Demand trends will differ from region to region. | Based on the outlook for changes in the energy mix over a very long period through 2050, we prepare for scenarios for changes in demand by area, and the areas to focus on will be identified based on the scenarios. (Reference: (1) Long-term megatrend analysis) |

| Crude oil |

|

||

| Thermal coal |

|

|

|

| Hydrogen/ Ammonia |

Transport volumes can be expected to increase as a result of the spread of hydrogen/ammonia mixed combustion | Focused resources on ammonia and hydrogen transport business development by specialized departments | |

| Steel raw materials |

|

Quality of transportation demand may change in preparation for an increase of iron scrap transportation. Arrange systems to meet high frequency and short distance transportation needs. | |

| Coking coal |

|

Establish fleet planning that allows us to adapt to changes in reducing agents used at steel works (coking coal → hydrogen, etc.) | |

| Electrification | Automobiles |

|

Increased intelligence to ensure fuel transition trends in land transportation. Mainly monitoring regulatory and policy trends as key items in long-term megatrend analysis and developing operation systems in line with increases and decreases in the scale of operations. |

| Change in consumer preferences | Grain |

|

Monitor vegan meat development trends and establish fleet planning that allows us to adapt to changes in production areas/demand areas. |

- Reference (1) Long-term megatrend analysis

-

As the business environment surrounding our group continues to change rapidly, in the process of preparing our company's medium- to long-term management plan "BLUE ACTION 2035," which was announced in March 2023, we conducted a long-term megatrend analysis to imagine the world and society structure in the future and to identify future scenarios that we consider as a company-wide project.

The project aims to develop multiple scenarios for long-term macro-external environmental changes, such as population growth, changes in regional population ratios, slowing of global economic growth, responses to climate change issues, energy shifts (progress in electrification: expansion of renewable energy), and technological evolution, and analyze these impacts on our group's business environment, lead to strategic considerations. Specifically, the impact on our business that emerges in the form of stricter environmental regulations, improved energy efficiency, reduced demand for fossil energy and increased demand for new energy is grasped from multiple perspectives, widely shared at the management level, and used to verify the resilience of our strategy over a very long period of time.For details, please refer to page 9 of MOL Group Management Plan "BLUEACTION 2035."

②Examples of Measures to Respond to Physical Risks

| Climate change risks and opportunities | Impact on MOL businesses | Countermeasures | |

|---|---|---|---|

| Products impacted | Overview | ||

| Flood/typhoon | Common |

|

Risk reduction is possible by establishing a network in which accurate forecasts of weather and sea conditions are made and information is instantly shared by all operating vessels ⇒ developing a business process to select appropriate navigation routes (Reference (1) - Refer to the explanation of the Safety Operation Supporting Center) |

| Common | Acute risk of disruption of instructions and support from land to ships due to damage to land sites |

Formulation and implementation of emergency response systems and contingency plans in the event of a disaster (Reference (3) - Refer to the explanation on risks related to natural disasters and epidemics) |

|

| Common | Indirect acute risk that disrupts the freight supply chain and reduces transport demand |

(Reference (4) - Refer to the explanation on risk diversification) |

|

| Drought | Dry bulk (Grain) |

Chronic risk of reduced load movement due to reduced grain yield | Although there are concerns about a local reduction in cargo movements, the global impact is expected to be compounded due to the large trade patterns of grain. Responding to local impacts by maintaining and strengthening our overall ability to deal with other trades and freight. |

| Deforestation | Dry bulk (Wood chip) |

Chronic risk of changes in trade structure due to changes in major timber supply areas |

Maintaining and strengthening the global shipping network in response to changes in trade patterns (Reference (5) - Refer to the explanation on the global shipping network) |

| Rising sea levels | Common | Chronic risks affecting port terms of use |

There are possible spillover effects such as an increase in the loading capacity in ports with strict draft restrictions. (Reference (6) - Refer to the explanation on the sea level rise scenario assumption) |

| Changes in ecosystems | Common | Chronic risks of intensified quarantine problems such as the stink bug problem on carboats |

Refinement of operations to respond to stricter quarantine systems and differentiation through certification of response systems (Reference (7) - Refer to the explanation on measures against stink bugs in our company) |

Reference (1) Safety Operation Supporting Center

The Safety Operation Supporting Center (SOSC) was established in February 2007 with the motto "Do not leave captains alone" with 24 hours, 365 days support and help desk function. Currently, two people, including an actual captain are on duty all the time to keep track of the latest positions and weather and sea information of all operating vessels in real time and to provide information to the vessel. Keeping in mind the lessons learned from past accidents, we are making every effort to prevent serious accidents in order to achieve the world's highest level of safe operation.

For details, please refer to the corresponding page of the website (Organization to support Safe Operation).

Reference (2) Risks associated with the operation and operation of ships, offshore plants, etc.

In order to prevent marine accidents, our company has taken various measures in terms of software and hardware, including education and guidance for seafarers and the preparation of hull specifications to ensure safety, in close cooperation with the Safety Operation Headquarter, the respective sales headquarters, shipowners and ship management companies. In addition, in the event of damage to our company itself or any other party caused by an unavoidable accident despite our best efforts, we have provided the necessary amount of insurance (liability insurance, hull insurance, war insurance, non-working loss insurance) to avoid a significant impact on our business performance and to secure sufficient sources of compensation. Furthermore, in order to reduce reputation risk, we conduct emergency training once a year on how to respond to serious marine accidents and disseminate information in the event of an accident, and employ media consultants when necessary.

For details, please refer to the appropriate page of the website (Risk Management > Risks Associated with Operations of Vessels and Offshore Plants).

Reference (3) Risks related to natural disasters and epidemics

We have formulated a Business Continuity Plan (BCP) to prepare for the possibility that large-scale disasters, etc. may cause damage to our company's facilities, equipment, and employees, thereby interfering with our business activities. The BCP has developed a response organization, authority etc. for the implementation of operations related to the maintenance of safe operation of vessels, the performance of transport contracts and charter contracts, financial provision, and the securing of personnel, and has compiled specific implementation procedures into manuals. We also have a backup system for satellite offices and systems.

For details, please refer to the appropriate page of the website (Risk Management > Natural Disaster and Epidemic Risks).

Reference (4) Risk diversification

Our group operates dry bulk ships, oil carriers, LNG carriers, automobile carriers and container ships, and carries various types of cargo in a range from resources to finished products. Market conditions for freight rates or rents are formed for each type of cargo, ship type, and business. While some of these are highly correlated, some economic conditions cancel out each other's fluctuations. By expanding a wide range of ship types and businesses, we aim to achieve stable management that is not affected by market fluctuations in specific ship types or businesses.

For details, please refer to the appropriate page of the website (Risk Management > Dispersing risks).

Reference (5) Global shipping network

Our company has established sales offices in 41 cities in 29 countries and maintains a global ship-distribution network. The entire world is divided into five regions (Europe/Africa, East Asia, Southeast Asia/Oceania, South Asia/Middle East, Americas), each of which has a regional general representative in charge of the executive officer. Under this system, regional organizations with corporate, marketing, and sales functions are established to promote business development led by regional organizations.

For details, please refer to the corresponding page of the website (MOL Group > List by Location).

Reference (6) Sea level rise scenario assumption

The assumption of sea level rise, which is a prerequisite for risk analysis, is based on the description in the Sixth Assessment Report of the IPCC (Working Group I). In the 2050 section, the assessment is described in the above table. However, it is pointed out that the possibility of a significant sea level rise of about 2-5 m in some scenarios cannot be ruled out in the period up to 2150, although the degree of certainty is low (SSP5-8.5). In the case of sea level rise on such a scale, there are concerns about severe social and economic impacts on the world, and it cannot be ruled out that there will be huge impacts on the shipping industry beyond changes in port usage conditions. In this sense, we will keep a close eye on developments in related discussions not only on the TCFD's range of 2050, but also on its impact in the ultra-long term.

Reference (7) Measures against stink bugs in our company (Past case)

In order to prevent stink bugs from invading crops such as fruits and vegetables, the Australian Ministry of Agriculture has strengthened the quarantine of oceangoing vessels visiting Australia. In September 2020, after extensive consultations with agricultural pest experts, Australian authorities, and other stakeholders, our company became the first Japanese shipping company to obtain certification from the Australian Ministry of Agriculture to certify that the various activities carried out by its fleet on routes from Japan and Korea to Australia meet the standards set by the Australian Ministry of Agriculture. As a result, quarantine inspections at ports in Australia are smoother and the risk of delayed unloading of loaded vehicles has been reduced.

For details, refer to the corresponding page of the website (Press Release > MOL Becomes 1st Japanese Car Carrier Operator to Obtain VSPS Certificate from Australia's Department of Agriculture).

(6) Migration plan

①MOL Group Environmental Vision 2.2

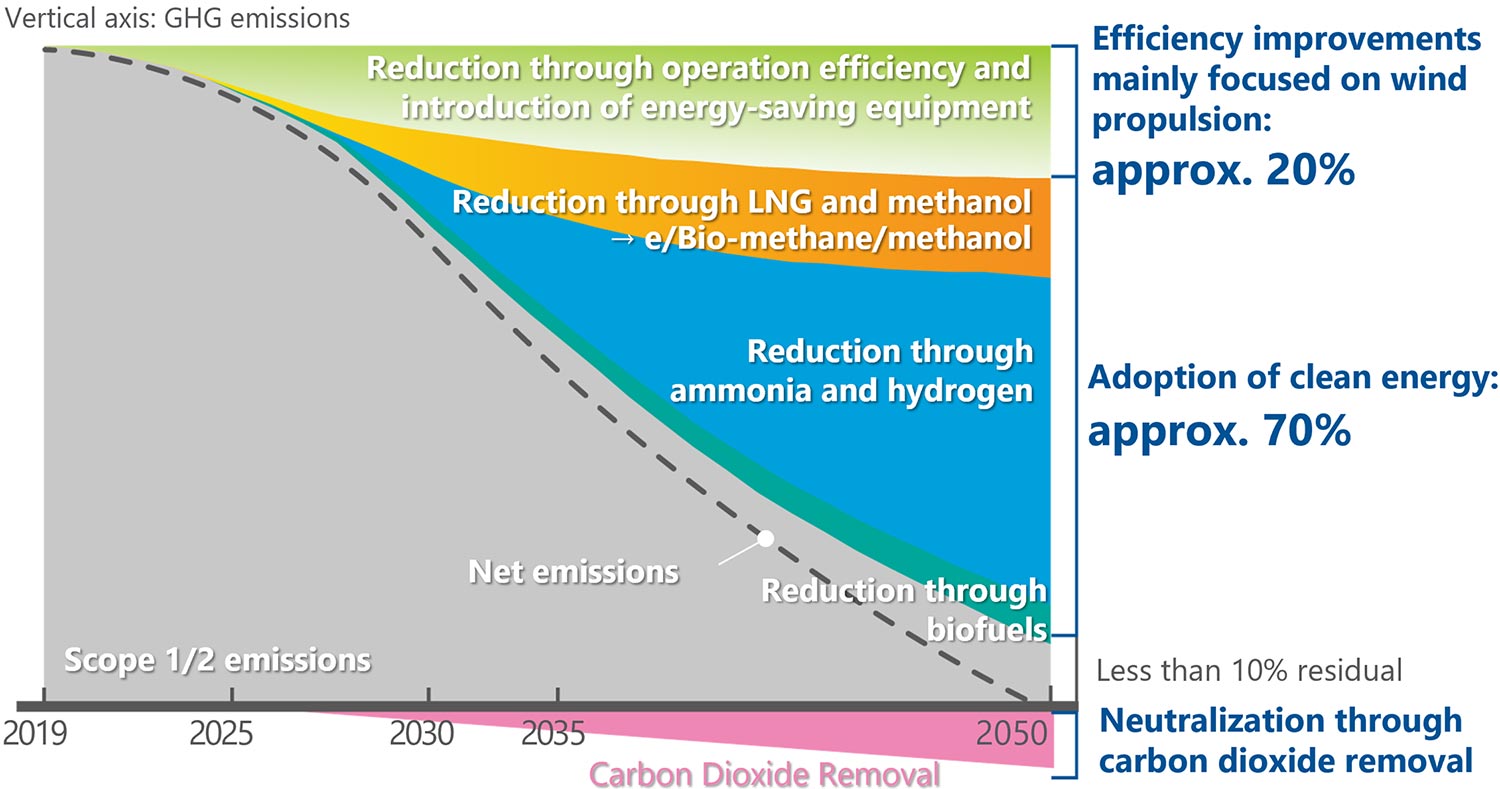

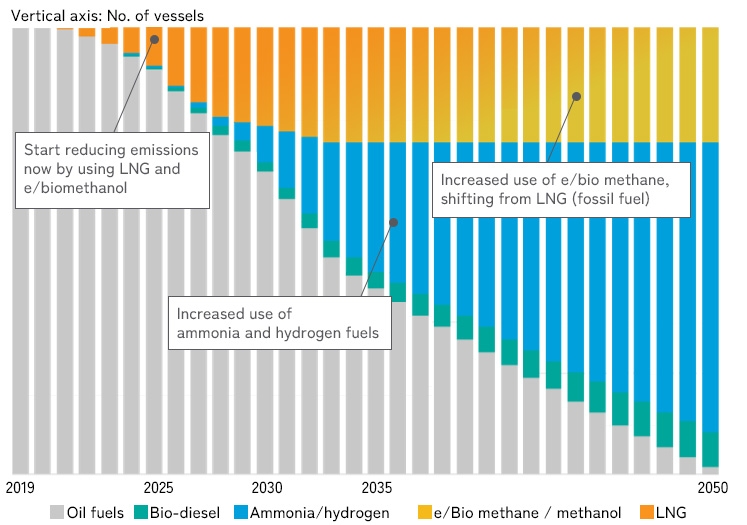

MOL formulated a GHG emissions reduction scenario for achieving net zero GHG emissions by 2050 as part of Environmental Vision 2.2, and this scenario is consistent with the 1.5°C scenario. We will also monitor trends in matters which have a significant bearing on implementation of the transition plan such as carbon tax and GHG emission rules and periodically review the plan taking factors such as technology trends into consideration.

MOL has established an interim target of a 45% reduction in GHG emission intensity from transport by 2035 and indicated a specific pathway for achieving net zero GHG emissions by 2050.

We have established five specific actions for reducing GHG emissions, including the adoption of clean energy, enhancement of energy-saving technologies, and expanding decarbonization projects and have set a target of investing around 650 billion yen in the decarbonization field over the three years from 2023 to 2025 (reduction of our own GHG emissions: 350 billion yen; contribution to reduction of society's GHG emissions: 300 billion yen). As of the end of March 2025, we have already achieved our target of 958.8 billion yen in investments, including those for decision making.

We recognize that transitioning our fleet composition by fuel type is a key theme in our efforts to reduce GHG emissions from our own operations. With the aim of commencing the operation of net zero emission oceangoing vessels in the latter half of the 2020s, we have set milestones for our medium-term initiatives: introducing 90 LNG/methanol-fueled oceangoing vessels by 2030, and approximately 130 net zero emission oceangoing vessels by 2035.

In the area of domestic vessels as well, we have already developed electrically powered net zero emission ships, with operations having commenced in April 2022.

②Five specific actions

For details, please refer to "Environmental Vision 2.2."

3. Risk Management

Our company, which operates a wide range of businesses around the world, is exposed to various risks. As a company-wide risk management response system, each risk type has its own department in charge, and in accordance with prescribed rules and regulations, we take risk reduction measures, including identifying the amount of risk, reducing exposure through hedging, and transferring risk through insurance, etc. The status of risk management by each division is regularly reported to the Management Committee, and information is centrally managed and necessary decisions and actions are made.

Since climate change is positioned as one of the major risks, the Environment & Sustainability Division classifies and evaluates climate change-related risks identified by each department and conducts risk management on a group basis in accordance with the above process.

More specifically, we have classified the "introduction of carbon tax" and "changes in cargo movements" as high priority risks with both a high degree of impact and a high probability of occurrence.

Please refer "Risk Management" for details on our company-wide risk management system.

4. Indicators and Targets

(1) KPIs related to reducing GHG emissions

As part of MOL Group effort to reduce GHG emissions, we have established the following targets. The medium- and short-term targets have been set as milestones toward achieving our long-term goal of net zero emissions by 2050. These targets have been calculated and established based on the necessary and achievable levels of GHG emission reductions required to attain net zero emissions.

Furthermore, the reduction target for the shipping industry set by the International Maritime Organization (IMO) in July 2023 is "to reach net zero GHG emissions from international shipping by around 2050." MOL Group long-term target is aligned with this level.

- <Long-term target> With the concerted effort throughout the Group, achieve net zero GHG emissions by 2050

<Mid-term target> Reduce GHG emissions intensity by 45% by 2035 (versus 2019) *1

<Short-term target> Reduce GHG emission intensity by 1.4% per year (versus 2019) *2

- *1 In addition to Scope 1, part of Scope 3 covered (international marine transport operated by MOL). Scope2 emission reduction target was set in "MOL group Environmental Vision 2.2".

- *2 In addition to Scope 1, part of Scope 3 covered (international marine transport operated by MOL). Average up to 2030.

* For detailed GHG emissions results, please refer to "Sustainability Data."

* For more information on our policy regarding SBTi, please click here.

①GHG emissions: Results and targets

| Results | Target | |||||

|---|---|---|---|---|---|---|

| FY2019 | FY2022 | FY2023 | FY2024 | FY2050 | ||

| GHG emissions (thousand tons) |

Scope 1 | 11,990 | 10,859 | 10,780 | 10,428 | Net zero *Scope 1, 2, 3 |

| Scope 2 | - | 19 | 18 | 19 | ||

| Scope 3 | 8,666 | 7,341 | 7,502 | 8,409 | ||

- * Businesses covered: All businesses of MOL Group, MOL + consolidated subsidiaries

- * Scope covered: All of Scope 1, 2, and 3 covered

②GHG emission intensity: Results and targets

| Results | Target | |||||

|---|---|---|---|---|---|---|

| FY2019 | FY2022 | FY2023 | FY2024 | FY2035 | ||

| GHG emission intensity (g/ton-mile) |

Standard method | 12.12 | 11.59 | 11.25 | 10.95 | 6.67 (-45% reduction against FY2019) |

- * Businesses covered: International marine transport business, MOL + major consolidated subsidiaries

- * Scope covered: In addition to Scope 1, part of Scope 3 covered

- *For the methodology for calculating emissions and intensity, please refer to "MOL group Envionmental Vision 2.2"

③KPI List by Action

To achieve the group's GHG emission reduction targets, we will take five actions.

Also, to ensure the achievement of net-zero emissions, we have set quantitative KPIs and milestones for measuring progress for each action.

(2) Assets and businesses related to climate change risks and opportunities

Regarding the carbon tax, which is a significant factor in climate change risk, the EU-ETS, which is currently in effect, targets ships of 5,000 GT or more calling at EU ports, and 40% of all GHG emissions is subject to the tax from the first year of the program in 2024. Approximately 1% of our shipping business emissions is subject to the levy, based on our Scope 1 emissions in FY2024. For details of other risks and their financial impact, please refer to the strategy part.

(3) Investments related to climate change risks

To address climate change risk, MOL plans to make investment of around 650 billion yen in the low-carbon and decarbonization field over the three years from 2023 to 2025 (with plans for 380 billion yen of new investment in addition to the 270 billion yen of investment already decided). For details, please refer to BLUE ACTION 2035 (management plan).

The Group's major future capital investments will be made in line with its long-term GHG emission reduction target (to achieve net zero emissions by 2050). In addition, investments in carbon-intensive assets and products, such as fossil fuel-powered ships, will be phased out in favor of investments in clean energy and other decarbonized assets and products.

- Positioning of environmental investment in BLUE ACTION 2035 (management plan)

Financial Plan / Cash Allocation:Outlook in Phase1(FY2023-FY2025)

- Excerpt from "Environmental Strategy" page of BLUE ACTION 2035 (management plan)

Investments in Phase 1 aligned with Environmental Strategy (Cash out basis)(billions of yen) Already

DecidedNew Subtotal Reduction of our Group's GHG Emissions 190.0 160.0 350.0 Low/Decarbonization Energy Business 190.0 110.0 300.0 Total 380.0 270.0 650.0

(4) Internal Carbon Pricing (ICP)

MOL introduced internal carbon pricing from FY2021.

[Overview of rule]

A fixed amount per 1 ton of CO2 emitted is set as the internal carbon price based on forecast carbon price charges in the international marine transport business. This is then used as an economic indicator when making investment decisions. It is standard practice at MOL to conduct a profitability assessment that, together with the carbon price charges MOL will incur as expenses in the future, also takes the impact of such charges on the market into consideration, and considers changes in overall economic potential, including profitability.

[Target Businesses]

Applies to the approval of all investment projects relating to the international marine transport business (also applies to investment projects in businesses other than the international marine transport business based on case-by-case basis)

[CO2 price]

[From January 2023 to December 31, 2034 ] US$ 65 /t-CO2

[From January 2035 to December 31, 2044] US$ 175/t-CO2

[After January 2045 ] US$ 20 0/t-CO2

* Set with reference to IEA's Sustainable Development Scenario ("well below 2°C scenario")

[Examples]

This ICP has already been applied to more than 10 investment decisions since its introduction. ICP was used when approving projects for "adoption of LNG-powered vessels" and "adoption of Wind Challenger (energy-saving system)," which are key items among measures to mitigate climate change under the environmental vision.

Example) Installation of the Wind Challenger system in vessels requires additional capital expenditure (CAPEX) but at the same time reduces fuel costs and CO2 emissions due to the energy saving effects. Use of ICP necessitates sufficient evaluation of the economic benefits of reducing CO2 emissions and, as a result, the advantages of installation of the system increase and the payback period of capital expenditure becomes shorter.

We intend to review the price of ICP from time to time, referring to outlooks by external organizations such as the IEA and also the progress of carbon taxes discussion in the international shipping industry, such as the EU-ETS, whilst ensuring consistency with the various conditions assumed in the aforementioned scenario analysis.

- Sustainability TOP

- Message from the Chief Sustainability Officer

- Sustainability

Management - Value Creation

Stories - Safety & Value

- Environment

- Human & Community

- Innovation

- Governance

- Stakeholder

Engagement - Sustainable Finance

- Sustainability Data

- ESG Disclosure

Guideline Indexes - External Recognition

- Library